In Focus

China Non-Life Insurance stable in Q1: Fitch Ratings

Aggregate comprehensive solvency ratio of the Chinese non-life insurance sector remained high at 238%.

China Non-Life Insurance stable in Q1: Fitch Ratings

Aggregate comprehensive solvency ratio of the Chinese non-life insurance sector remained high at 238%.

First quarter new funding for InsurTech surge 37.6%: Gallagher Re

This signals the industry may return to pre-COVID-19 levels in 2023.

2023 a mixed bag for Asian insurers: S&P

S&P also warns Asia insurers to be cautious of the effects of geopolitical risks

Asia’s economic loss due to natural catastrophes reached $5.39b: Gallagher Re

This was 7% of the estimated total economic loss of US$77b, globally.

InsuranceDekho building one-stop-shop to solve India’s fragmented insurance ecosystem

The insurtech firm secured $150m in Series A funding round

Protection gap in Southeast Asia a massive opportunity for insurers: S&P

Insurers can help insure the bottom 40% income group or address vulnerabilities to natural disasters.

Health planning amongst top financial goals of 3 in 10 Hongkongers

More than half use cash savings to accomplish such goal.

Philippine insurance density inches down in 2022

A total of 128 out of 130 companies submitted data to the Insurance Commission.

S.Korea insurance industry to see 4.7% jump in GWP in 2027

This is due to a regulatory proposal to deregulate digital insurance innovations.

India's first-year premiums drop 16.8% YoY in February

CareEdge Ratings attribute the decrease to the YoY decline in group premiums.

Demand for risk insurance in Asia 'steady' in 2023: Marsh

This is due to the expansion of the Asian market’s capacity for warranty and indemnity insurance

APAC outperforms as global insurance M&A hit 10-year high in 2022

A slowdown in M&A deals in H2 offset some regions' performance.

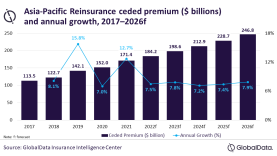

Natural hazard losses, inflation weigh on APAC reinsurers in 2023

Increase in costs of claims will add pressurers to profits.

Singapore's new insurance premiums fall 5.2% in 2022

Rising interest rates and inflation dented demand for life insurance products.

What key skills insurers are hunting for in new hires

Jobs in digital transformation, data management, and data analytics will remain competitive.

APAC insured losses reach $11b in 2022: Aon

Australian flooding events were the costliest for insurers with $4b in insured losses.

Singapore Business Review’s Insurance Rankings sees slow growth amongst top 50 insurers

The top 50 insurers saw 5.1% growth in 2021.

Advertise

Advertise