/Aditya Nara from Unsplash

/Aditya Nara from Unsplash

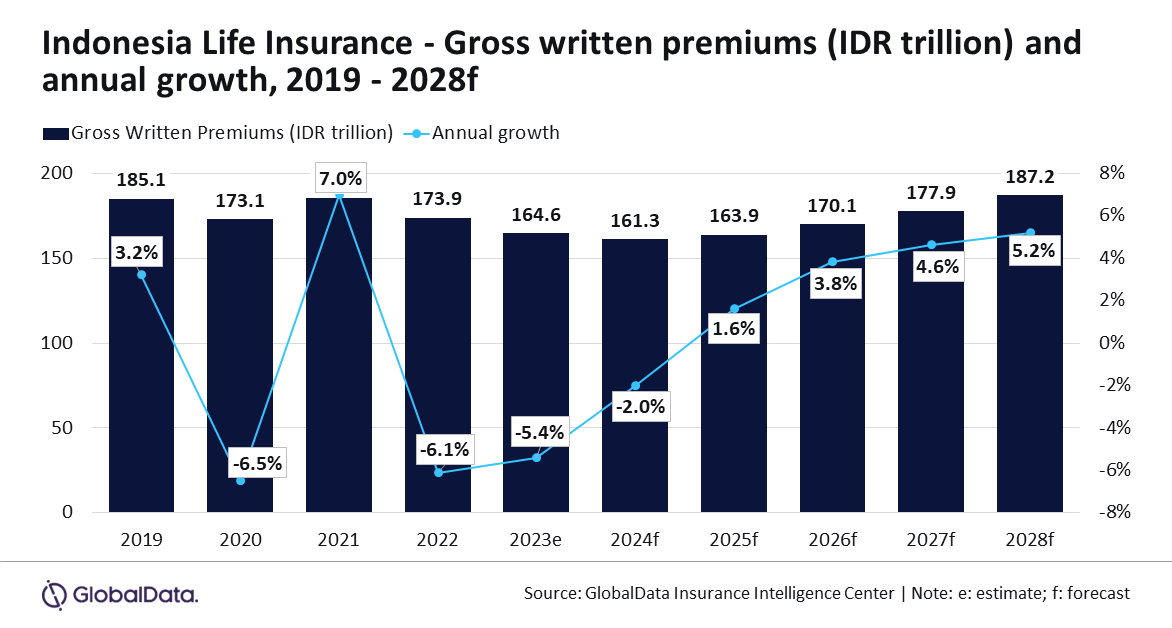

Indonesia's life insurance to reach $12.1b GWP by 2028

Endowment insurance is forecasted to decline by 7.0% in 2024.

The Indonesian life insurance industry is anticipated to grow steadily, with a compound annual growth rate (CAGR) of 3.8% from 2024 to 2028, reaching $12.1b in gross written premiums (GWP), according to GlobalData.

This growth projection follows a decline that began in 2022 and is expected to persist through 2024, primarily due to a decrease in endowment insurance policy sales.

“The Indonesian life insurance industry is expected to decline by 2.0% in 2024, after witnessing a 5.4% decline in 2023. The decline can be attributed to a decrease in the sales of investment-linked insurance products due to heightened volatility in global financial markets, as well as a decline in new premiums due to changing consumer preferences,” Manogna Vangari, Insurance Analyst at GlobalData, said in a media release.

“However, the industry is set to make a turnaround in 2025, driven by an increase in the demand for traditional life insurance policies and changes in the country’s demographic factors,” Vangari added.

Endowment insurance, the largest product in the market, is forecasted to decline by 7.0% in 2024, following a 10.9% drop in 2023, driven by market volatility and lower returns.

ALSO READ: Indonesia's vehicle sales drop risks finco asset quality

In January 2024, the Financial Services Authority of Indonesia (OJK) introduced guidelines for the supervision of investment-linked insurance product marketing. These guidelines encompass consumer data protection, consumer rights and obligations, transparency regarding fees and commissions for marketing agents, and procedures for handling complaints and dispute resolution.

However, traditional long-term and protection insurance plans are gaining popularity among consumers, with guidelines expected to enhance consumer confidence and support endowment insurance growth in the long term, projected at a CAGR of 1% from 2024 to 2028.

Personal Accident and Health (PA&H) insurance, the second-largest product, is anticipated to grow by 13.1% in 2024, supported by increasing health awareness and demographic changes, including an ageing society and high life expectancy.

PA&H insurance is forecasted to grow at a CAGR of 10.8% from 2024 to 2028.

Term life insurance, the third-largest product, is expected to grow by 9.8% in 2024, driven by an ageing population and rising disposable incomes.

New product developments, such as affordable term insurance plans, are also contributing to growth, with a projected CAGR of 7.9% from 2024 to 2028.

General annuity, whole life, and pension products are expected to collectively account for the remaining 4.0% share of GWP in 2024.

“Growing awareness of financial protection, rising disposable income, changing demographic factors, and favourable regulatory and product developments are expected to support growth in the Indonesian life insurance industry over the next five years.” Vangari concluded.

Advertise

Advertise