/Rawpixel.com from Freepik

/Rawpixel.com from Freepik

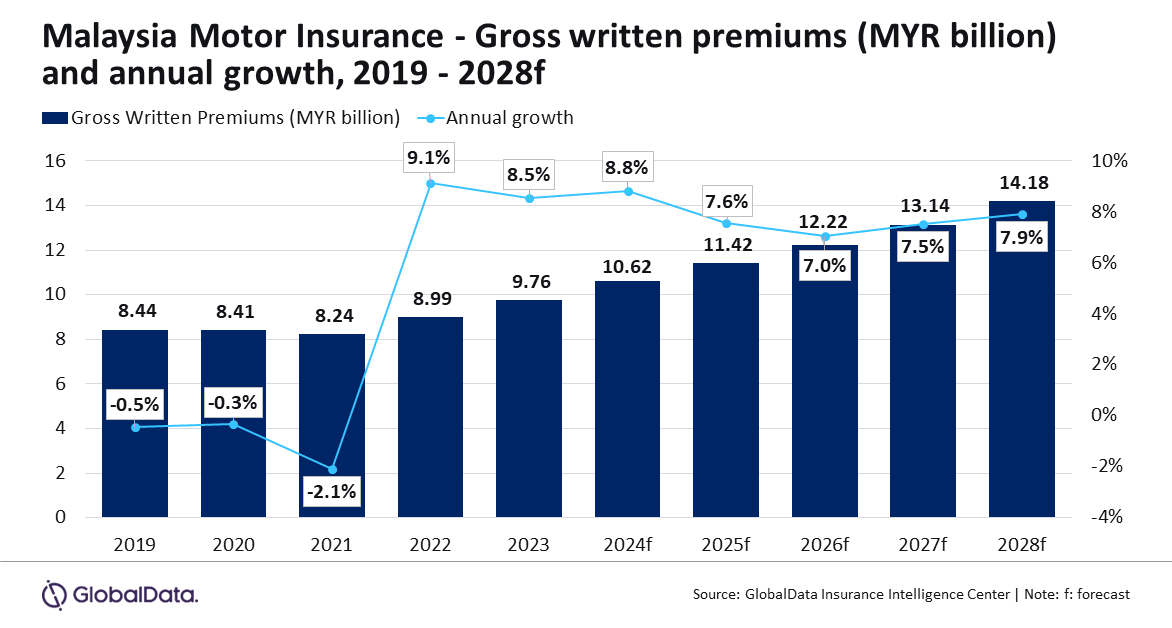

Malaysian motor insurance set for 7.5% growth by 2028

The industry is seen to account for more than 45% of the general insurance sector.

The Malaysian motor insurance market is projected to expand at a compound annual growth rate (CAGR) of 7.5%, growing from $2.3b in 2024 to $3.1b by 2028.

“Malaysian motor insurance industry growth peaked in 2022, driven by economic recovery and favourable regulatory developments that have led to an increase in vehicle sales. The high demand for vehicles has aided motor insurance growth in 2023, a trend that is expected to continue in 2024,” Swetansha Chauhan, Insurance Analyst at GlobalData, said in a media release.

Motor insurance is expected to represent over 45% of Malaysia's general insurance industry in 2024 and is forecasted to grow by 8.8% in that year, driven by increasing vehicle sales and rising premium prices, research from GlobalData showed.

The Malaysian Automotive Association (MAA) reported a 12.5% rise in vehicle sales, totalling 799,731 units in 2023.

“Rising premium prices will also support motor insurance growth. The prices for automobiles have increased over the last couple of years due to excess demand and global economic volatility, which has led to an increase in premiums for motor insurance policies,” Chauhan said.

This surge was fueled by a backlog of bookings from the sales tax exemption period, which ended in March 2023.

During this period, locally assembled vehicles received a 100% sales tax waiver, and imported vehicles were eligible for a 50% waiver if purchased between 15 June 2020 and 31 March 2023.

From 1 March 2024, the Malaysian government increased the service tax on motor insurance policies from 6% to 8%, raising costs for policyholders. This change will also affect labour charges for repairs and maintenance, leading to higher premiums.

Claims also saw an uptick in 2023, returning to pre-pandemic levels. The General Insurance Association of Malaysia (PIAM) noted a 1.4 percentage point increase in the motor insurance loss ratio, reaching 66.7% due to higher accident rates.

The Traffic Investigation and Enforcement Department recorded a 9.7% rise in traffic accidents, totalling 598,635 cases in 2023, up from 545,588 in 2022. Fatalities surged by 104%, with 2,417 reported in 2023 compared to 1,183 in 2022.

Consequently, average motor insurance claims per day rose to RM15.1m in 2023, up from RM13.0m in 2022, marking the highest increase in five years.

The government's phased liberalisation of motor insurance pricing, which started in 2016, has allowed insurers to adjust premiums based on driving behaviour.

Phase 2B, implemented on July 1, 2023, permits adjustments of up to 20%, an increase from the previous 15% limit. Drivers with good behaviour will see greater reductions in premiums, whilst those with poor behaviour may face higher costs.

Insurers are increasingly investing in disruptive technologies to enhance their competitive edge and lower costs. Digitalisation has transformed underwriting and risk analysis, improving operational efficiency. Artificial Intelligence (AI) and machine learning (ML) models are streamlining underwriting processes and detecting fraud, which enhances overall product offerings.

“The Malaysian motor insurance industry is expected to maintain upward growth for the next five years, driven by an increase in vehicle sales and rising premiums. However, insurers’ profitability is expected to remain challenged over the next few years due to increasing claims and rising inflation,” concluded Chauhan.

Advertise

Advertise