/Denys Nevozhai from Unsplash

/Denys Nevozhai from Unsplash

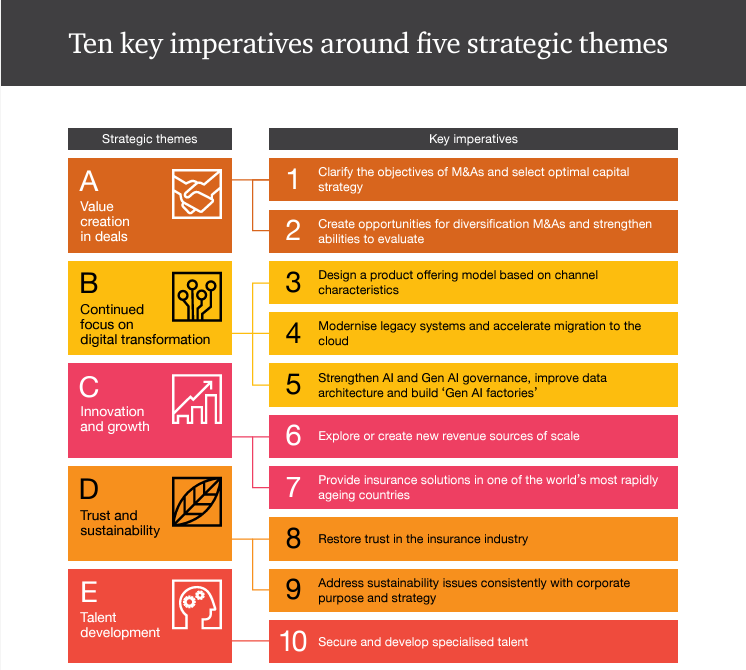

PwC outlines 10 imperatives for Japanese insurers

BOJ's rate shift could challenge Japanese insurers.

Japanese insurers are urged to address asset management and product pricing with wariness. Similarly, the probability that the Financial Services Agency of Japan (JFSA) will introduce the Insurance Capital Standard(ICS), along with the outlook for the economic environment, could revive reinsurance transactions.

According to PwC’s 27th Annual Global CEO Survey, CEOs globally are more optimistic about economic growth than last year, though they recognise inflation and macroeconomic volatility as primary threats.

In Japan, as the Bank of Japan (BOJ) reviews inflation and monetary policies, the financial services industry anticipates a shift to positive interest rates, a scenario unfamiliar to many current businesspeople.

PwC tells how Japanese insurers must adapt to remain competitive and pursue global growth through these 10 key imperatives:

Advertise

Advertise