Insurance

China clamps down on medical insurance fraud

Fraudsters may face a suspension of reimbursement for up to a year.

China clamps down on medical insurance fraud

Fraudsters may face a suspension of reimbursement for up to a year.

Indian insurers' lagging underwriting could hit long-term profits: report

Adequate earnings have not accompanied market growth.

Insurance and the Growing Demand for Hyper Personalisation

Kenneth Koh is the Global Principal and Director of Insurance, Financial Services Practice, SAS Institute.

Indian insurers can now invest in REITs, infrastructure trusts

This will boost the overall portfolio yield held by these firms.

Sun Life is 2020's top Philippine life insurer

It netted a $175m net income and $811m premium income.

Ping An boosts green activities in support of China's carbon goal

It proposes performance targets for green finance and measures for green growth.

AXA Hong Kong and Macau joins Green Monday ESG Coalition

It is the first insurer to join the coalition.

New specialty businesses to sustain Japan P&C insurers' capital

Growth of specialty products will support underwriting.

China's Leapstack seeks partnership with South Korean insurers

Leapstack will provide big data AI solutions to Korean commercial insurers.

India's LIC nets $24.4b in FY2021 new premiums

Its individual life business posted a first-year premium income of $7.5m.

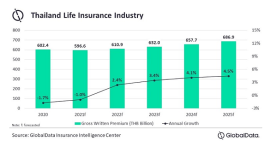

Thai life premiums to hit $22.8b in 2025

Whole life plans drive the sector, accounting for 72% of premiums in 2020.

HSBC Life names new global head of customer proposition

HSBC Life has appointed Ying Teoh as global head of customer proposition effective 12 April.

Munich Re Syndicate launches Labuan retakaful window

Labuan FSA has approved the window facility to write sharia-compliant risks.

Retained earnings, foundation funds buoy Nippon Life's capital

But its capital position is vulnerable to a slump in the Japan stock market.

Philippine senator seeks to include HMOs in insurance code

He also wants the Insurance Commission to be placed under the central bank.

Fraught capital markets put Chinese life insurers on edge

Credit exposure has become more vulnerable to rising defaults.

Philippine non-life insurers must apply new catastrophe rates by April 2022

The cession of facility rates will be based on a maximum limit per risk.

Advertise

Advertise